‘How bad will it get?’ – Air cargo market awaits impact of tariffs and de minimis changes

1. Weak Growth in April Amid Economic Uncertainty

In April 2025, global air cargo volumes grew by +4% year-on-year, but the outlook remains bleak. The removal of the de minimis threshold for shipments from China to the US starting May 2 is expected to severely disrupt the e-commerce market in the coming weeks.

2. De Minimis Removal: A Game Changer

For the past 10 years, US consumers have paid no duties on imports under $800, resulting in 1.35 billion parcels annually entering the US. From May 2, however:

- Low-value goods from China and Hong Kong are subject to 145% tariffs

- If sent via postal services: 120% or a $100 flat fee, rising to $200 on June 1

About 50% of China–US air cargo is e-commerce, accounting for 6% of global air cargo volumes. The anticipated demand drop will likely disrupt airline capacity planning.

3. Initial Impact: Flight Cancellations and Rerouting

Several freighter services from China to the US have already been canceled or rerouted. Major Chinese e-commerce platform Temu has cut its advertising spending in the US.

Niall van de Wouw of Xeneta warned:

“This affects global supply chains, not just one industry.”

4. Freight Rates and Jet Fuel Prices Fell in April

- Spot airfreight rates rose only +3% YoY, the second month of single-digit growth.

- Jet fuel prices dropped -24% YoY, easing rate pressure.

- Available capacity increased +3%; dynamic load factor fell to 57% (down 3 percentage points month-on-mon

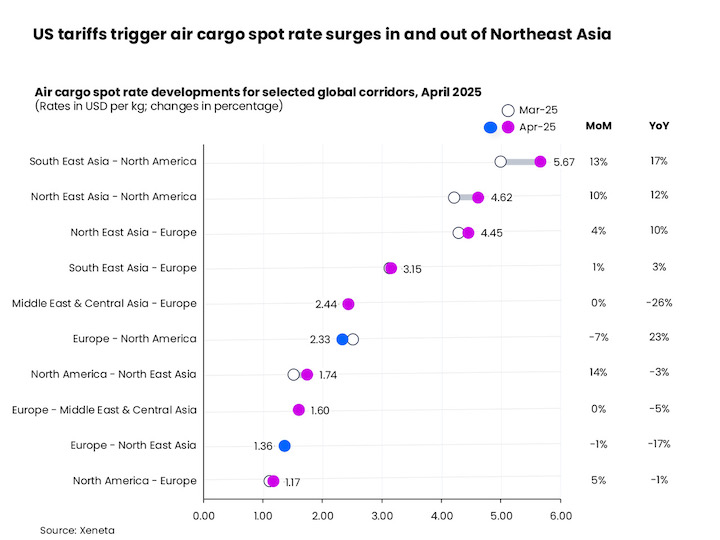

- 5. Early April Tariff Actions Boosted Demand

The US’s “Liberation Day” tariff measures on April 2 triggered a rush in air cargo from Asia to North America:

- Rates from Southeast Asia: up +13% MoM

- Rates from Northeast Asia: up +10% MoM

But this spike began reversing in late April after the 90-day tariff pause and China’s 145% retaliatory tariffs.

6. Rate Trends by Region

- North America → Northeast Asia: strongest rise at +14%

- Middle East & Central Asia → Europe: flat MoM, but down -26% YoY

- Transatlantic Westbound: fell -7% MoM due to summer bellyhold capacity and Easter slowdown

- Northeast Asia → Europe (fronthaul): up slightly MoM, +10% YoY

- Europe → Northeast Asia (backhaul): fell sharply, -17% YoY

7. “Waiting to See How Bad It Gets”

Van de Wouw noted that April’s data didn’t reflect full impact:

“Nothing’s changed yet – companies are in limbo. They’re trying to mitigate, but don’t know the outcome. The big question: what will 2025 bring?”

The true effect of the de minimis change will show in May’s data.

8. US Consumers Will Start to Notice

One clear example: a $19.49 power strip from Temu became $48.38 after shipping and taxes.

“The era of free shipping from China is over,” said van de Wouw.

9. 2025 Growth Forecasts Now Irrelevant

2025 was projected to grow 4–6% YoY, but now any forecast is meaningless due to extreme market uncertainty.

10. Will Tariffs Stick?

- Lower airfreight rates may help shippers, but tariffs could still kill demand

- If tariffs remain, volumes from China to the US will drop

- Airlines will adjust their networks, potentially freeing up capacity for other regions

“This is likely the calm before the storm. If the new rules stay, global volumes will suffer – and traditional air cargo can’t fill the e-commerce gap.”

Contact Tan Son Nhat Cargo now for the earliest consultation support.

Learn more:

Chuyến bay 33 giờ làm cả thế giới nín thở năm 1927

Mỹ và Nga hợp tác đất hiếm: Giảm phụ thuộc vào Trung Quốc

C919: Bước tiến lớn của Trung Quốc trong ngành hàng không toàn cầu

Qatar Airways Cargo lập kỷ lục trong năm thành công vượt bậc