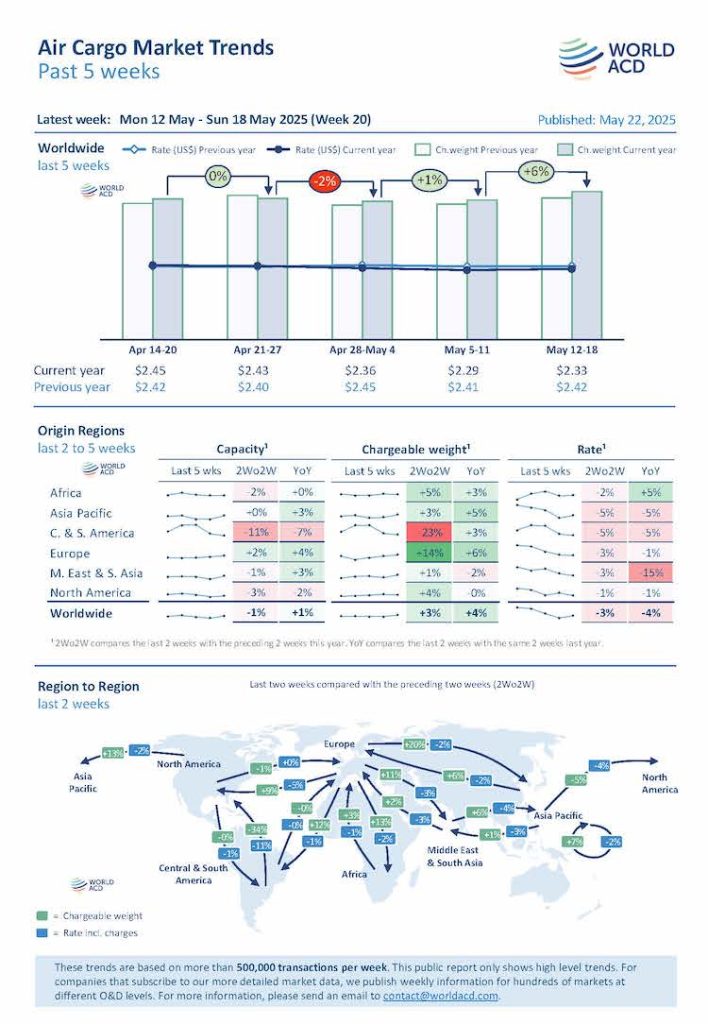

WorldACD Weekly Air Cargo Trends – Week 20 (12–18 May)

Global air cargo tonnages rose sharply in week 20, increasing by +6% week-on-week (WoW). This rebound was largely driven by a strong recovery in volumes from Asia Pacific, helped by a temporary easing of US-China trade tensions and the return to normal activity following holidays in Japan and South Korea.

According to WorldACD Market Data, around two-thirds of the global increase came from:

-

China and Hong Kong (+8%)

-

Japan (+60%) – recovering after Golden Week (29 April–6 May)

-

South Korea (+21%) – following Children’s Day (5 May)

These gains led to an overall +11% WoW rise in air cargo tonnage from Asia Pacific. Strong increases also came from:

-

Middle East & South Asia (MESA): +11% WoW

-

Europe: +6% WoW

US-China Tariff Developments and Impact

On 2 May, the US ended de minimis exemptions for low-value imports from China and Hong Kong and raised tariffs on many goods. This caused a drop in air cargo volumes and the cancellation of many transpacific freighter services.

However, a partial reversal of these measures on 12 May, including:

-

Cancelling some tariffs

-

Suspending others for 90 days

-

Easing de minimis changes

…led to a strong rebound. Volumes from China and Hong Kong to the US jumped +19% WoW, returning close to early April levels.

At the same time, spot rates on this route stabilized at around US$4 per kilo, following a sharp spike in late April, especially out of Hong Kong.

Traffic to Europe Also Rises

Air cargo volumes from China and Hong Kong to Europe also strengthened:

-

China-Europe volumes increased +9% WoW

-

Combined volumes from China and Hong Kong to Europe neared their peak-season levels (Nov–Dec 2024)

On pricing:

-

China-Europe spot rates dropped -5% WoW to $3.71/kg

-

Hong Kong-Europe spot rates rose slightly (+2% WoW) to $4.39/kg, though still below this year’s average of $5/kg

Flower Shipments Decline Post-Mother’s Day

The overall increase in global tonnages was partly offset by a -4% WoW drop from Central & South America (CSA). This decline followed a post-Mother’s Day (11 May) drop in flower shipments. Minor declines also came from:

-

North America: -2% WoW

-

Africa: -1% WoW

In a two-week-on-two-week (2Wo2W) comparison:

-

CSA tonnage fell -23%, but remained +3% higher YoY

-

Most other origin regions showed YoY growth, except:

-

MESA: -2% YoY

-

North America: flat (0%)

-

Rates Overview

-

Global average rates: $2.33/kg, up +2% WoW, driven by gains from Asia Pacific

-

Spot rates: averaged $2.50/kg, also up +2% WoW

-

Both metrics are down compared to last year:

-

Overall rates: -4% YoY

-

Spot rates: -3% YoY

-

On the pricing side, worldwide average rates of US$2.33 per kilo edged up slightly higher (+2%) in week 20 compared with the previous week, thanks largely to a +2% WoW increase from Asia Pacific origins, although both were down by -4% compared with week 20 last year. And the pattern for spot rates was similar, with average worldwide spot rates of US$2.50 rising +2% WoW, but -3% below last year’s levels.

The sharpest YoY price drop was seen in the MESA region:

-

Spot rates: -23%

-

Average rates: -15%

Although prices are now slightly lower, YoY, from most origin regions, the biggest YoY change is for MESA origins, where spot rates and overall average rates are down by -23% and -15%, respectively, compared with their inflated levels this time last year.

Contact Tan Son Nhat Cargo now for the earliest consultation support.

Learn more:

Chuyến bay 33 giờ làm cả thế giới nín thở năm 1927

Mỹ và Nga hợp tác đất hiếm: Giảm phụ thuộc vào Trung Quốc

C919: Bước tiến lớn của Trung Quốc trong ngành hàng không toàn cầu

Qatar Airways Cargo lập kỷ lục trong năm thành công vượt bậc