Atlas Air Warns of Supply-Side Constraints in Air Cargo Market

Industry Faces Capacity Limits Despite Growing Demand

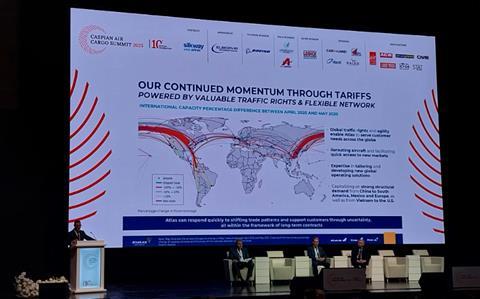

The global air cargo industry is entering a period of strong demand growth, but its ability to meet that demand may be constrained by limited fleet expansion and the retirement of older aircraft. Speaking at the Caspian Air Cargo Summit, Martin Drew, Chief Strategy and Transformation Officer at Atlas Air Worldwide, outlined both the opportunities and challenges shaping the sector in the coming years.

Demand Outlook Remains Strong

Drew emphasized that despite ongoing geopolitical and economic uncertainty, air cargo demand is expected to expand steadily. According to Atlas Air projections, overall air cargo traffic will grow by approximately 4% per year between now and 2030.

-

E-commerce remains the key driver, with growth estimated at around 10% annually.

-

International express services are forecast to expand by 3% per year.

-

General cargo is expected to see more moderate gains of 2.7% annually.

This trend highlights how consumer habits, particularly the shift toward online shopping, continue to reshape supply chains and logistics strategies worldwide.

E-Commerce Players Adjust to Regulatory Changes

Drew noted that leading e-commerce platforms such as Temu and Shein have adapted quickly to evolving trade regulations. The United States recently ended the “de minimis” exemption, which had allowed small parcels to enter the country duty-free with minimal customs scrutiny.

-

Shein has responded by meeting new customs requirements and broadening its focus to attract older consumers in the U.S., thereby creating fresh demand channels.

-

Temu is diversifying its strategy by targeting new international markets.

Meanwhile, shifting U.S. tariff policies are prompting changes in sourcing and production. Manufacturing is increasingly moving to Southeast Asia, while China is pivoting its export focus toward regions such as Europe, Mexico, and South America.

Supply Side Remains Tight

Despite promising demand figures, Drew warned that supply-side limitations could hinder industry growth. The global widebody freighter fleet is projected to expand by less than 1% annually through 2030, falling short of demand-driven requirements.

Forecasts indicate that new aircraft will enter the market in limited numbers:

-

43 widebody freighters in 2025

-

36 in 2026

-

35 in 2028

-

34 in 2029

-

36 in 2030

However, many of these deliveries will be offset by retirements, particularly of ageing MD-11Fs. In total, around 130 widebody freighters are expected to exit service by 2030.

This dynamic means that the global widebody freighter fleet will grow only modestly—from 655 aircraft at the end of 2025 to 685 aircraft in 2030, representing a net gain of just 4.4% over five years.

Aircraft Production and Conversion Challenges

The situation is further complicated by production backlogs and conversion bottlenecks. Drew highlighted that the global backlog of aircraft orders has reached a record 17,000 units, putting additional pressure on manufacturers and operators.

New freighter models are entering the market, but progress is slow. For example, Israel Aerospace Industries (IAI) recently secured approval for its Boeing 777 passenger-to-freighter conversion program, yet access to suitable feedstock remains limited. The Boeing 777 continues to enjoy high popularity in passenger operations, reducing availability for freighter conversion.

On the passenger side, narrowbody aircraft such as the Airbus A321X are increasingly deployed on long sectors of up to eight hours. While efficient for airlines, these aircraft offer only limited bellyhold cargo capacity, constraining additional lift for shippers.

Supply–Demand Imbalance Could Constrain Growth

Taken together, these factors point toward a tightening supply environment. “Limited newbuilds, constrained conversion slots, and the retirement of aircraft continue to widen the gap between supply and demand,” Drew explained.

He cautioned that the supply side could become a structural constraint on the industry’s growth potential. While demand is projected to rise consistently through 2030, the lack of significant fleet expansion means air cargo operators will need to manage capacity carefully and seek innovative solutions to meet customer needs.

Outlook

The air cargo sector faces a paradox: robust demand growth powered by e-commerce and shifting global supply chains, but a constrained supply base that may limit the ability of carriers to fully capitalize on that growth. For Atlas Air and the wider industry, balancing these dynamics will be critical in shaping future strategies.

Please contact Tan Son Nhat Cargo for prompt assistance

Mở rộng nhà ga quốc tế Tân Sơn Nhất: Giải pháp giảm ùn tắc

Hãng bay mới vừa xuất hiện trên thị trường bao giờ vận hành?

Từ 18/8, Bamboo Airways chuyển toàn bộ chuyến bay nội địa sang nhà ga T3